By: Shmuel Leshem*

Empirical evidence shows that termination fees (“lockups”) in merger agreements of public companies discourage competition for the target company but do not necessarily harm target shareholders. This Article presents a signaling theory consistent with this evidence and considers the theory’s normative implications. The chief argument is that the presence of a lockup in an agreement signals the acquirer’s high valuation of the target, and this discourages other potential acquirers from competing. By increasing the deal price in exchange for the inclusion of a lockup in the agreement and thereby restricting competition, a target company and a high-valuing acquirer are able to divide between them the surplus that results from avoiding the transaction costs of a bidding contest. Building on that analysis, this Article shows that although lockups increase target shareholder wealth, they may nevertheless be socially undesirable.

Introduction

The bulk of merger and acquisition deals of public companies in the United States are negotiated transactions.[1] A distinctive feature of these deals is a built-in delay between the signing of the purchase agreement and closing upon approval by the target shareholders.[2] In this interim period, potential acquirers may attempt to disrupt the pending deal by making a competitive bid. Merger and acquisition agreements therefore often contain termination provisions (“lockups”), whereby the target company (the “target”) promises to pay the acquirer if the target is eventually sold to another acquirer. The use of lockups not only has increased over time,[3]but has also become increasingly important in merger and acquisition deals.[4]

The effects of lockups on mergers and acquisitions have been the subject of extensive empirical research. The empirical evidence on lockups provides two main findings. First, lockups are associated with a higher probability of deal completion and a lower probability of third-party competition.[5] This suggests that lockups truncate the natural course of a takeover bidding process.[6] Second, lockups benefit target shareholders through higher deal premiums.[7] Taken together, the evidence suggests that bidders use lockups not only to ensure a minimum return if the deal fails, but also to deter potential higher-valuing bidders from competing.[8] These observed effects of lockups pose a twofold conundrum: Given that lockups deter competition from other potential acquirers, what do target companies gain by agreeing to include them in the merger agreement? And if target companies agree to lockups because the higher deal price outweighs their loss from the reduced competition, what do acquirers gain from lockups?[9]

Perhaps surprisingly, the existing law and economics literature provides no explanation for this conundrum. Furthermore, the dominant theory of lockups, proposed in a seminal article by Ian Ayres in 1990, projects that lockups would have no effect on the outcome on bidding competitions and therefore lockups will not deter potential higher-valuing acquirers from competing.[10] The empirical findings on lockups, therefore, seem all the more puzzling in light of the previous theoretical literature. The following analysis seeks to fill this gap between theory and evidence and to thereby shed light on parties’ interests to employ lockups in merger and acquisition agreements.

This Article argues that lockups are often used to save acquirers substantial costs that they would incur if a competition occurred. First, a bidding contest forces acquirers to incur significant costs in financing bidding rounds, irrespective of whether they eventually win or lose the contest. Second, a competition increases acquirers’ opportunity costs resulting from a prolonged bidding process—for example, if an auction occurs, the acquirer’s board must devote time and effort to managing the bidding. Third, the prospect of competition reduces the value of acquirers’ early expenditure on reliance investments.[11] By negotiating for a lockup, acquirers indicate their high value for the target, which in turn deters other potential acquirers from initiating a bidding contest. The savings from lockups allow such high-valuing acquirers to compensate the target for its loss from the reduced competition.

Drawing on insights from game theory, this Article treats a bidding contest as a strategic interaction between an acquirer, a target, and potential contesters under conditions of incomplete information.[12] Because a lockup is exchanged for an increase in the merger price, and a higher lockup amount is given for a higher increase in the deal price, a lockup and its amount constitute a signal revealing the acquirer’s high valuation for the target. Potential bidders who must decide whether to incur bidding costs would be reluctant to compete once they observed that the deal contains a lockup. The inclusion of a lockup, therefore, generates a surplus that the acquirer and the target can share. Finally, a lockup is a credible signal for the acquirer’s high valuation because the target itself is ignorant of the acquirer’s valuation and thus will only agree to a lockup for a sufficiently high increase in the deal price.[13]

This Article unfolds as follows. Part I surveys existing lockup theories in the law and economics literature. Part II presents a background of signaling theory, surveys the financial literature on signaling in takeovers, and explicates why these signaling strategies are less effective in friendly than in hostile corporate acquisitions. Part III lays out the intuition for having a separating equilibrium in which high-valuing acquirers credibly distinguish themselves from low-valuing acquirers by purchasing a lockup. This Part then presents a numerical example that illustrates this intuition. Part IV discusses the normative implications of the theory.

I. A Survey of Lockup Theories

The early view of lockups perceived them as instruments by which merger parties could reduce the target valuation for potential acquirers, and thereby to interfere with the natural course of bidding contests.[14] This perception was called into question by Ayres, who pointed out that lockups reduce the target valuation both for the lockup recipient as well as for potential acquirers.[15] Accordingly, lockups do not affect the outcome of bidding contests. Only above-expectation lockups, or foreclosing lockups, may alter the course of a bidding contest by decreasing bidders’ valuations of the target below the deal price. In a subsequent study, Hanson and Fraidin pushed Ayres’s argument to its logical conclusion by stating that “like chicken soup, [lockups] can’t hurt but may well help.”[16]

Acknowledging Ayres’s reasoning, Kahan and Klausner argue that the existence of bidding costs might render lockups foreclosing.[17] Kahan and Klausner’s argument is based on the asymmetry between the first bidder’s and potential rivals’ entry costs: whereas the first bidder’s bidding costs are sunk, potential contesters have yet to incur these costs. By granting a lockup, the target confers on the first bidder the advantage of having its costs sunk, and thereby can induce a first bidder to bring forward a bid. Kahan and Klausner’s theory thus predicts that first-bidder lockups might affect second bidders’ motivation to enter a bidding contest for the target, yet fails to explain the higher return for target shareholders in lockup deals.[18]

Later scholarship further refined the upshot of Ayres’s analysis. Roosevelt, drawing on Cramton and Schwartz’s analysis, invoked auction theory to explain the use of lockups to reduce entry in common value auctions.[19] Roosevelt’s explanation acknowledges the negotiation over lockups that takes place between the target and the first bidder and suggests that a lockup is given to the first bidder in exchange for increasing the deal price.[20] A first bidder will be willing to increase the deal price because a lockup reduces the number of bidders in equilibrium and thereby increases the first bidder’s expected profit from making a bid. Roosevelt’s explanation, however, does not apply to the more common independent private-values auctions.

Other studies have suggested various explanations for the use of “stock lockups.”[21] Burch points to the fact that a stock lockup gives the first bidder an equity stake in the target, which induces him to bid more aggressively if competition occurs, but overlooks the target’s motivation in selling a termination fee.[22] Officer stresses the public-good nature of a first bid and suggests that lockups may be a means for internalizing the positive externality of a first bid, but fails to explain how lockups would reduce competition.[23]

II. Signaling in Takeovers

A. Incomplete Information and Signaling

In situations of asymmetric information, one party possesses private information that cannot be communicated credibly to other parties. The informed party can thus benefit from taking a costly action (“signal”) aimed at credibly conveying his information. By observing the signal, the uninformed parties can update their belief about the information possessed by the informed party, thereby taking a different action than that which they would otherwise have taken. The informed party’s profit will consequently be greater than if he had not signaled his information. For signaling to be effective, however, other parties must not find it optimal to mimic the informed party by incurring the cost associated with the signal.[24]

Signaling models have been harnessed to explain a myriad of economic phenomena. For example, a signaling theory was invoked to explain why public companies distribute dividends despite the double taxation imposed on such distribution.[25] According to this theory, high-quality firms will find it optimal to incur the extra cost involved in distributing dividends if they thereby separate themselves from low-quality firms. By signaling their type, high-quality firms reduce the cost of future equity issuance. The effectiveness of a dividend distribution as an indicator for a company’s quality is conditioned on low-quality firms not finding it profitable to imitate that strategy even if they could lower the cost of raising capital by disguising as high-quality firms. Dividend distribution will be used to signal quality so long as the profit resulting from the lower cost of raising capital outweighs the cost associated with distributing dividends.[26]

B. Bidders’ Signaling Strategies in Takeovers

A natural starting point for evaluating takeover contests is to compare them to English auctions. In a takeover contest, as in an English auction, bidders raise their bids until the highest-valuing bidder wins the target at the reservation price of the second highest-valuing bidder.[27] Like an English auction, bidders in takeover battles are ignorant of their opponents’ valuations of the target. A takeover contest, however, entails costs that are not present in the classic English auction. In particular, in an English auction, bidders have relatively low (or zero) investigation and bidding costs. In takeover contests, by contrast, these costs are substantial.[28] In addition, a takeover battle––as opposed to an English auction––is launched with a first bidder’s bid that identifies the target as a takeover candidate. Potential competitors thus have to decide whether to compete after observing the first bidder’s bid. The presence of investigation and bidding costs implies that the decision whether to compete involves weighing the costs of acquiring information about the target against the expected profit from entering a competition (that is, the probability of winning multiplied by the profit from acquiring the target). The higher the first bidder values the target, the lower the expected profit of subsequent bidders who enter a bidding contest. Thus, a potential bidder’s decision whether to acquire information about the target is derived from, among other things, its belief about the first bidder’s valuation of the target. The first bidder could therefore profit from a bidding strategy that dissuades potential rivals from competing by signaling a high valuation.

The finance literature has suggested that bidders can signal their high valuation, and thereby discourage potential contesters from competing, by bidding preemptively: offering a high premium initial bid.[29] A natural setting for preemptive bidding is a unilateral bid (or a tender offer), in which the target does not negotiate the deal price directly with the bidder. A bidder’s decision to increase its bid over the target’s market price thus amounts to a (voluntary) cost incurred by the bidder, and therefore is likely to be interpreted by potential bidders as an indication of that bidder’s high valuation of the target. In friendly acquisitions, in which the deal price is determined jointly by the target and the acquirer, the ability to bid preemptively is limited. This is because the merger price is the product of both parties’ private information on the deal’s profitability and therefore also reflects the target’s private information on its reservation price. Accordingly, potential rivals may be reluctant to interpret a high merger price as a signal of the acquirer’s high valuation of the target, and instead will attribute the higher price to private information possessed by the target regarding its own value. Consequently, an acquirer may not be able to simply increase the merger price to deter entry. Moreover, the acquirer may not be able to choose the form of transaction and therefore may have available only a limited arsenal of signaling strategies. For example, if the target installed antitakeover measures such as a poison pill, the first bidder would be unable to launch a hostile bid. The only alternative then would be a (friendly) merger, in which the acquirer should negotiate directly with the target board to gain support for the merger.

III. Lockups as Signals

A. A Signaling Theory of Lockups

Imagine a world in which there are two types of first bidders: high- and low-valuing. Suppose that a first bidder negotiates with the target for a lockup in return for an increase in the merger price. Suppose further that a potential second bidder is considering whether to investigate the target to decide whether to pursue bidding.[30] What would be the effect of including a lockup provision on the second bidder’s belief about the first bidder’s valuation of the target, and thereby on the second bidder’s motivation to investigate the target value?[31]

The main argument of this Article is that a first bidder’s decision to buy a lockup is driven by signaling motivations. The signaling property of lockups emanates from the fact that the first bidder is required to incur an additional cost––a higher merger price––in exchange for having a lockup. Because high-valuing first bidders stand to lose more from competition than low-valuing first bidders, they will be willing to incur that additional cost to differentiate themselves from low-valuing first bidders. Having a lockup signals that the first bidder values the target highly and thereby discourages potential rivals from competing.[32]

Signaling a high valuation for the target reduces competition because potential second bidders’ decision whether to enter a bidding contest is dependent on their beliefs about the first bidder’s valuation of the target. Thus, if potential second bidders believe that the first bidder values the target highly, they will be reluctant to incur investigation costs and will choose to bid only upon observing a high target valuation. Likewise, potential bidders will be more amenable to investigate the target and will bid upon observing a low target valuation, if they believe that the first bidder attaches a low value to the target.

B. The First Bidder’s Strategy

This Subpart uses a numerical example to illustrate the argument that lockups are used as entry-deterrence signals. I begin by fixing the lockup price and demonstrating that high-valuing first bidders will differentiate themselves from low-valuing first bidders by purchasing a lockup. The intuition behind this outcome is that low-valuing first bidders stand to profit less from reducing competition, and therefore will not find it profitable to mimic high-valuing first bidders’ strategy even at the expense of revealing their vulnerability. For analytical purposes, I defer to the next Part the analysis of the target’s decision as to whether to consent to include a lockup in the agreement.

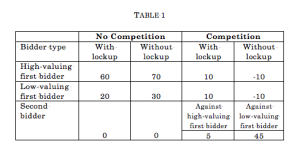

To explicate the first bidder’s decision whether to buy a lockup, consider the following stylized example. Assume that first bidders could be either high- or low-valuing with equal probability. High-valuing first bidders value the target at 740, whereas low-valuing first bidders value the target at 700. During the merger negotiations, the first bidder could choose between paying a lower price for the target without a lockup and paying a higher price for the target accompanied by a lockup. In particular, suppose that the first bidder could buy a lockup of 20 in return for an increase of 10 in the merger price.[33] Suppose further that the deal price is set at 670 without a lockup and that, if a competition evolves, both types of first bidders will incur an additional cost of 10, irrespective of the value of its counter bid; that is, the first bidder incurs an additional cost of 10 even if it does not counter bid the second bidder’s bid.[34]

After a merger agreement between the target and the first bidder has been signed, a second bidder has to decide whether to compete. This decision is made in two stages. In the first stage, the second bidder has to decide whether to incur investigation costs of 5 in order to estimate the target value. In the second stage, depending on its valuation of the target, the second bidder has to decide whether to make a bid for the target. If the second bidder decides to enter a competition, it will have to incur additional bidding costs of 10. For simplicity, assume that after finding its valuation of the target, the second bidder faces no uncertainty as to the outcome of a bidding contest. Thus, assume that after incurring investigation costs of 5 there is an 80% chance that the second bidder will find the value of the target to be lower than 700 and a 20% chance that the second bidder will find the value of the target to be 760. Thus, given that the first bidder is equally likely to be high- or low-valuing, the second bidder’s expected profit from investigation is positive ((0.8 × -5) + (0.2 × 25) > 0).[35] Note that the second bidder’s expected profit from investigation is negative if the probability that the first bidder is high-valuing is greater than 5/8.[36] This, in turn, prompts the high-valuing first bidder to signal its high valuation and to thereby deter the second bidder from investigating the target.

Consider next first bidders’ profit if there is no competition. The high-valuing first bidder would profit 70 if it did not buy a lockup and 60 if it did. Similarly, the low-valuing first bidder would profit 30 if it did not buy a lockup and 20 if it did.[37] I assume that, if a competition occurs, the first bidder and the second bidder will bid up to their reservation price.[38] The first bidder’s profit, however, is reduced by the amount of its bidding costs.[39] Recall also that the first bidder’s reservation price is reduced by the lockup value. Therefore, the high-valuing first bidder would bid up to 740 if it did not buy a lockup and up to 720 if it did. Likewise, the low-valuing first bidder would bid up to 700 if it did not buy a lockup and will refrain from bidding if it did (note that in this case the merger price is also the low-valuing first bidder’s reservation price of the target).

The second bidder’s profit depends on the first bidder’s type. If the second bidder competes against the high-valuing first bidder, it will win the target at 740 or 720––depending on whether a lockup is included in the agreement. If the second bidder competes against the low-valuing first bidder, it will win the target at 700 or 680––again depending on whether a lockup is present in the agreement. Note that the second bidder’s profit does not depend on the presence of a lockup, but rather on the first bidder’s type. The irrelevance of the lockup to the second bidder’s profit is a corollary of Ayres’s argument: a lockup reduces first and second bidder’s reservation prices by the lockup value.[40] As a result, the cost of a lockup is borne by the target shareholders who receive a lower price for their shares if a competition for the target occurs.

The following table summarizes first and second bidders’ profits under different contingencies in a tabular form:

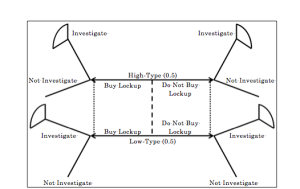

FIGURE 1

The game starts with Nature (or chance) selecting the first bidder’s type––high- or low-valuing––with equal probabilities. The open nodes in the center represent Nature’s choice of the first bidder’s type and the numbers in brackets, beside the first bidder’s type, indicate the prior probabilities for each type. As the game starts, the first bidder knows its type and has to decide whether to buy a lockup of 20 in exchange for an increase of 10 in the merger price. The two pairs of arrows stemming from the central nodes denote the first bidder’s choice whether to buy a lockup. After the first bidder chooses whether to buy a lockup, the second bidder has to decide whether to investigate the target. The four corner nodes denote the circumstances under which the second bidder’s decision is made, so that each node corresponds to a different combination of first bidders’ type and decision to buy a lockup. The four pairs of diagonal arrows originating from the corner nodes denote the second bidder’s choice whether to investigate the target.[41] When the second bidder chooses whether to investigate the target value, it knows whether the first bidder bought a lockup, but does not know the first bidder’s type. The dashed line connecting each pair of corner nodes depicts the second bidder’s ignorance of the first bidder’s type.

I proceed by showing that the high-valuing first bidder’s decision to buy a lockup signals its high valuation of the target. For that end, I will show that the unique perfect Bayesian equilibrium,[42] which satisfies the intuitive criterion,[43] is as follows: (1) the high-valuing first bidder buys a lockup and the low-valuing first bidder does not buy a lockup; (2) the second bidder investigates the target only if the first bidder did not buy a lockup; and (3) the second bidder’s belief is that the presence of a lockup indicates that the first bidder is high-valuing, whereas the absence of a lockup implies that the first bidder is low-valuing.

To see that this is indeed a perfect Bayesian equilibrium, consider first bidders’ expected profits under the above equilibrium strategies. The high-valuing first bidder’s expected profit would be 60 if it bought a lockup (recall that the second bidder would not compete if the first bidder bought a lockup) and 54 otherwise ((0.8 × 70) + (0.2 × -10)). Given the second bidder’s equilibrium strategy, the high-valuing first bidder has no incentive to deviate from its equilibrium strategy (that is, buy a lockup). The low-valuing first bidder’s expected profit would be 20 if it bought a lockup (recall that the second bidder would not compete if the first bidder bought a lockup) and 22 otherwise ((0.8 × 30) + (0.2 × -10)). Given second bidders’ equilibrium strategies, the low-valuing first bidder as well lacks an incentive to deviate from its equilibrium strategy (that is, to not buy a lockup).

Table 2 summarizes the first bidders’ profit contingent on their decision to buy a lockup, given the second bidders’ equilibrium strategy:

Table 2: Bidder’s Profit

|

Type/ Strategy |

With lockup |

Without lockup |

|

Low-valuing first bidder |

20 |

22 ((0.8 × 30) + (0.2 × -10)) |

|

High-valuing first bidder |

60 |

54 ((0.8 × 70) + (0.2 × -10)) |

Table 2 shows that the high-valuing first bidder is better off buying a lockup, whereas the low-valuing first bidder is better off not buying a lockup, given that the second bidder believes that a lockup is a signal of the first bidder’s high valuation of the target.

Consider next the second bidder’s expected profit under the above equilibrium strategies. Recall that under the proposed equilibrium, the high-valuing first bidder buys a lockup and the low-valuing first bidder does not buy a lockup. The second bidder’s expected profit from incurring investigation costs if a lockup is not included in the merger agreement (that is, if the first bidder is low-valuing) is 5 ((0.8 × -5) + (0.2 × 45)). Because the expected profit from incurring investigation costs is positive, the second bidder has no incentive to deviate from its equilibrium strategy (to investigate if a lockup is not included in the merger agreement). By contrast, the second bidder’s expected profit from incurring investigation costs if a lockup is included in the merger agreement (that is, if the first bidder is high-valuing) is -3 ((0.8 × -5) + (0.2 × 5)). Because the expected profit from incurring investigation costs is negative, the second bidder has no incentive to deviate from its equilibrium strategy (to not investigate if a lockup is included in the merger agreement).

C. The Target’s Strategy

The previous Subpart has shown that high-valuing first bidders profit from signaling their type through the purchase of a lockup. The inclusion of a lockup in a merger agreement, however, requires the target’s consent. Yet discouraging potential bidders from competing reduces the target’s expected profit from signing the merger agreement. What then do targets gain by agreeing to include a lockup in a merger agreement?[44] This question is further supported by empirical evidence showing that targets are better off in auctioned sales.[45]

The answer to this question is that the effect of a reduced competition for the target depends on the first bidder’s type: a low-valuing first bidder would drive up the bid price less than a high-valuing bidder. Therefore, if an auction occurs, the target’s expected profit is lower if the first bidder is low-valuing than if it is high-valuing. The target is ignorant of the first bidder’s type, however. The low-valuing first bidder cannot credibly propose the target a low lockup price, because the target will suspect it to be a high-valuing first bidder. Offering a high price, on the other hand, is not profitable for the low-valuing first bidder. Because a low price is not indicative of the first bidder’s type, the target must only accept a high price, which only high-valuing first bidders could afford. By offering the target a high lockup price, a first bidder credibly signals its high valuation to potential bidders and concomitantly proposes the target to share the surplus brought about by preventing competition.

To gain insight into the negotiations between the target and the first bidder, consider a reverse “market for lemons.”[46] In the classic “market for lemons” model, George Akerlof used the market for used cars as an illustrative example of a market where sellers possess more information about the quality of the goods offered for sale than buyers.[47] Akerlof argues that in such markets, low-quality units are more likely to be traded than high-quality units.[48] High-quality units are not offered in the market because buyers, ignorant of individual asset quality, discount all used-asset prices not knowing which units on the market are the lemons. In response to buyers’ strategy regarding the maximum price for an unidentified unit, owners of high-quality units will stay out of the market. This, in turn, will cause buyers to further discount the maximum price that they are willing to pay for an asset whose value is uncertain. This process repeats itself so that in equilibrium the market consists of predominantly low-quality units. The market thus becomes biased toward “lemons.”

A parallel dynamic takes place in markets where buyers possess more information about the quality of the goods offered for sale than sellers (a reverse “market for lemons”). In such markets, high-quality units are more likely to be traded than low-quality units. Low-quality units are not traded in the market because sellers must take into account the fact that for any price they set, buyers will accept the offer when the value of the asset being sold is lower than the price set. Thus, if a low price is set, sellers cannot deduce from buyers’ acceptance that the asset sold is low-quality. In contrast, by setting a high price sellers are assured that they are not selling a high-quality asset at too low a price. In equilibrium the market consists of predominantly high-quality units. The market thus becomes biased toward “cherries.”

Consider now the sale of a lockup. In the “market for lockups,” the unit of trade is the signaling property of lockups. The buyer (the first bidder) possesses more information about the value of the signal than the uninformed seller (the target). The value of a lockup as a signal depends on the first bidder’s private information regarding its valuation of the target. In this informational setting, a reverse “market for lemons” emerges. When setting the minimum price it would accept, the target must take into account the fact that the first bidder will offer a high price only when it values the lockup highly (that is, when the first bidder is high-valuing). The uncertainty about the value of the lockup increases the minimum price at which the target will agree to sell a lockup. A sale of a lockup is nevertheless mutually profitable because there are sufficient gains to be realized by restricting competition, as the first bidder’s expected loss from competition is higher than the target’s expected profit. By setting the minimum lockup price sufficiently high, the target is assured that the first bidder is high-valuing, and therefore is guaranteed that it will not sell a lockup for too low a price. Thus, it is the existence of asymmetric information between the target and the first bidder that produces a credible signal regarding the first bidder’s high valuation of the target.

To illustrate this argument, recall the numerical example presented in the previous Part. Consider the highest price that the first bidder will be willing to pay for a lockup given that a lockup deters the second bidder from competing. The high-valuing first bidder’s expected profit if it did not buy a lockup would be 54 ((0.8 × 70) + (0.2 × -10)).[49] With a lockup, the high-valuing first bidder’s profit is 70. Therefore, the highest price that the high-valuing first bidder would pay for a lockup is 16. The low-valuing first bidder’s expected profit if it did not buy a lockup would be 22 ((0.8 × 30) + (0.2 × -10)).[50] With a lockup, the high-valuing first bidder’s profit is 30. Therefore, the highest price that the low-valuing first bidder would pay for a lockup is 8.

Consider now the target’s decision whether to include a lockup in the agreement. Because the target does not know the first bidder’s valuation, it will agree to a lockup if its expected profit from competition given that the first bidder is high-valuing is higher than (or equal to) its expected profit if competition does not occur. The target’s expected profit from competition, given that the first bidder is high-valuing, is 684 ((0.8 × 670) + (0.2 × 740)).[51] Therefore, the target will agree to a lockup in exchange for a minimum price increase of 14.

Note that the difference between the target’s minimum acceptable lockup price and the high-valuing first bidder’s maximum lockup price is equal to the first bidder’s expected bidding costs of 2. Thus, the negotiation range within which a sale of a lockup may take place is derived from the presence of bidding costs for the first bidder.

IV. A Normative Analysis

A. Economic Analysis Framework

Two standards are invoked to evaluate takeover regulation: efficiency[52] and revenue maximization.[53] Efficiency involves three main concerns. The first has to do with management’s incentive to engage in self-dealing prior to and while negotiating with a potential acquirer;[54] the second looks to initial bidders’ incentive to search and make bids for acquisition candidates; and the third involves the net benefit (loss) from transferring the target’s assets to a higher-valuing user, less the transaction costs involved in such a transfer.[55] The standard of revenue maximization involves maximizing returns for target shareholders.

Commentators usually favor efficiency over revenue maximization, because increasing target shareholders’ wealth usually entails a corresponding decrease in the acquirer’s profit. From a social standpoint, there is no reason to favor the target shareholders over the acquirer shareholders.[56] Courts, however, resort to revenue maximization because management’s conduct is reviewed in light of its fiduciary duty to maximize target shareholders’ wealth.[57]

Consider first management’s conflict of interest. Management’s interest diverges from that of shareholders when negotiating a merger or acquisition with a potential acquirer. Whereas shareholders face a valuable “exit” opportunity, managers might lose their jobs if the new acquirer prefers a fresh management team to run the target. Because board approval is required in most acquisition methods, the target board is given significant power to control the outcome of negotiated acquisitions.[58]

The Board’s power to control the outcome of the negotiations may be exploited to the detriment of the target shareholders. For instance, target managements might agree to a lower acquisition price in exchange for side payments or certain board positions. Likewise, target managements might strike a deal with a favored acquirer to prevent an unfriendly acquirer from taking over the target. Managements’ self-dealing, in turn, weakens the disciplinary power of the market for corporate control. Takeover regulation should thus restrict managements’ ability to engage in such self-dealing conduct.

Consider next potential bidders’ incentives to search and make bids for target candidates. Initial bidders’ incentive to engage in search activity depends on their ability to recoup their investment in identifying undervalued target companies.[59] Yet, a prospective acquirer is not certain to harvest its investment in discovering a potential target. In the period between the signing and closing of the purchase agreement, potential rivals might make a competitive bid for the target. The initial bidder’s commitment to acquire the target provides those potential bidders with valuable information regarding the target valuation, thus lowering their costs of investigating the target.[60] Allowing competition between rival bidders shifts the acquisition surplus away from acquirers and toward target shareholders. As a consequence of the absence of exclusivity, potential acquirers’ motivation to search and make bids declines. A potential contester’s decision whether to enter a competition for the target thus involves a negative externality as it does not take into account the effect of competition on the level of search by initial bidders.[61] Takeover regulation should respond to this externality by protecting initial bidders’ investment in information acquisition, thereby providing bidders sufficient incentive to engage in search activity.

Finally, consider the social gains from transferring the target’s assets to a higher-valuing bidder compared to the transaction costs involved in such a transfer. An auction facilitates an expeditious transfer of the target’s assets to a higher valuing user, but also involves transaction costs. When considering whether to initiate a takeover auction, a second bidder does not take into account the costs incurred by the first bidder as a result of such competition. As noted above, those costs include not only direct bidding costs but also costs associated with a greater uncertainty as to whether the deal will close. As a consequence, a second bidder’s decision to compete for the target involves a second type of negative externality: higher transaction costs for the first bidder.[62] Takeover regulation should thus encourage only those acquisitions in which the value realized through transferring the target assets to a higher-valuing user is higher than the transaction costs involved in such a transfer.

B. Normative Implications

1. Efficiency

According to the theory proposed in this Article, lockups are likely to deter potential higher-valuing second bidders from competing by indicating that a first bidder attaches a high valuation to the target. This, in turn, provides managements with greater power to preclude competition from higher-valuing bidders than is suggested by current theories. By consenting to a lockup, managements decrease the probability of competitive bids; and by refusing a lockup provision, managements increase the probability of such bids. Managements might exploit this power to attain private benefits. Granting a lockup in exchange for private benefits not only harms target shareholders but may also detract allocational efficiency by precluding a higher-valuing bidder from acquiring the target.[63] Some empirical studies show that deal premiums in lockup deals are higher than in non-lockup deals, suggesting that lockups are exchanged for an increase in the deal price, and therefore that managers do not systematically engage in self-dealing when granting lockups.[64]

The theory proposed in the Article differs from previous analyses in its emphasis on transaction costs and in its consideration of the efficiency effects of the absence of a lockup from a merger agreement. First, although lockups deter potential higher-valuing second bidders from competing, they nevertheless may promote efficiency through saving in transaction costs. Previous analyses usually disregard the costs involved in bidding competitions, and those scholars who considered them restricted the benefit resulting from the saved transaction costs to common value auctions.[65] This Article argues, in contrast, that in private-value auctions as well, efficiency may be served by preventing competition, because a competition involves socially wasteful transaction costs. Second, and perhaps more important, the analysis in this Article suggests that in considering the efficiency effects of lockups, one should take into account the consequences of the absence of lockups on the level of competition. Thus, the absence of a lockup from a merger agreement will raise the level of competition (relative to a world without lockups) and thereby increase the transaction costs associated with bidding competitions. This, in turn, may lead to an inefficient outcome relative to a world without lockups. Transaction costs thus turn out to be a crucial factor in evaluating the efficiency effect of lockups. Third, consideration of the implications of the absence of a lockup from a merger agreement has ramifications for initial bidders’ incentives to search. Prior analyses conclude that reducing the level of competition boosts the level of search. These analyses did not, however, consider the effect of the absence of a lockup on the level of competition. This Article suggests that the absence of a lockup increases the likelihood of competing bids and therefore may diminish potential bidders’ incentive to search.

2. Target Shareholders’ Returns

According to the theory proposed in this Article, because the acquirer is able to fully compensate the target for its loss from the prevention of competition, target shareholders’ returns in lockup deals are at least as high as in a world without lockups. If, in contrast, a lockup is not included in the deal, then the probability of competition is higher relative to a world without lockups. This is because the absence of a lockup indicates that the acquirer is low-valuing, and therefore induces potential competitors to investigate the target. In non-lockup deals, therefore, target shareholders are better off than in a world without lockups. Overall, then, target shareholders’ returns are higher in a world with lockups than in a world without them. Although it does not affect allocational efficiency, this corollary is important because shareholders’ revenue maximization is often invoked by courts when assessing takeover regulations.

3. Normative Prescriptions

The analysis above suggests that the efficiency effects of lockups are ambiguous: lockups may either advance or reduce social welfare. Target shareholders’ returns, in contrast, are higher in a world with lockups if lockups are negotiated at arm’s length. It follows that in reviewing the use of lockups, courts should focus on maximizing target shareholders’ returns, as this criterion provides clearer guidance than that of efficiency maximization. [66] The implication of this observation is that in reviewing lockups courts should focus on the negotiation process that led to the inclusion of a lockup in the deal and ensure that the lockup was negotiated at arm’s length.[67] Notice also that court reviews of the negotiation process of lockups endow the process with greater credibility—and the more credible signals for acquirers’ high valuation lockups become, the better managements are able to use them to maximize target shareholders’ returns.

Conclusion

Empirical evidence shows that lockups are associated with a lower probability of third-party competition and that they benefit target shareholders through higher deal premiums. This Article suggests a signaling theory consistent with this evidence. The chief argument is that lockups are used by acquirers to signal their high valuation of the target to potential rivals. Because high-valuing acquirers stand to lose more from competition than do low-valuing acquirers, high-valuing acquirers can distinguish themselves by negotiating for a lockup in exchange of a higher deal price. The target’s incentive to agree to a lockup and thereby to restrict competition stems from the fact that a bidding contest involves substantial transaction costs. By limiting competition, the target and a high-valuing acquirer are able to share the surplus that results from avoiding these costs. Lockups are credible signals because the target is ignorant of the acquirer’s valuation; the target’s loss from agreeing to a lockup is higher if the acquirer is high-valuing than if he is low-valuing. As a result, the target will only agree to a lockup for a sufficiently high increase in the deal price.

This Article complements existing theories by providing an account of potential acquirers’ decision whether to enter a bidding contest in the face of uncertainty regarding the existing acquirer’s valuation of the target as well as an explanation of the target’s motivation to include lockups in merger agreements. This explanation suggests in turn an important role for courts in reviewing lockups. Rather than focusing on the lockup amount, courts should primarily focus on the negotiation process that led to the inclusion of a lockup in the deal.

* Associate Professor, University of Southern California. This Article is based on my J.S.D. dissertation at New York University School of Law. I am very grateful to William Allen, Lewis Kornhauser, and Stanley Siegel for their continued support and advice.

[1]. See Gregor Andrade, Mark Mitchell & Erik Stafford, New Evidence and Perspectives on Mergers, 15 J. Econ. Persp. 103, 106 (2001) (“Only 4 percent of transactions in the 1990s involved a hostile bid at any point.”).

[2]. The reasons for the delay between signing and closing are several. First, bids to merge are indirectly subject to disclosure provisions of federal securities law. David Hirshleifer & I.P.L. Png, Facilitation of Competing Bids and the Price of a Takeover Target, 2 Rev. Fin. Stud. 587, 588 (1989). Second, the consideration for the merger may be securities, the offer of which must be registered under the Securities Act of 1933. 15 U.S.C. § 77a-77aa (2006). Third, additional delays may be caused by the pre-transaction competition filing. Thus, for example, the Hart-Scott-Rodino Act may require a filing and a waiting period. 15 U.S.C. § 18a(a)-(c) (2006). Finally, delay may result from the nature of the transaction itself. For instance, the acquirer may request a delay in affecting the transaction in order to line up financing. In addition, due diligence for some deals can take considerable time. As a consequence of these factors, mergers seldom close within ninety days of the execution of the merger agreement, and are sometimes delayed for as long as a year. Moreover, in a series of cases in the late 1990s, the Delaware Chancery put further limitations on a target’s ability to restrict potential bidders from competing by prohibiting the use of “no-shop” and “no-talk” clauses. See Phelps Dodge Corp. v. Cyprus Amax Minerals Co., Nos. CIV.A. 17398, CIV.A. 17383, CIV.A. 17427, 1999 WL 1054255, at *1–2 (Del Ch. Sept. 27, 1999); Ace Ltd. v. Capital Re Corp., 747 A.2d 95, 109 (Del. Ch. 1999).

[3]. See Thomas W. Bates & Michael L. Lemmon, Breaking Up Is Hard to Do? An Analysis of Termination Fee Provisions and Merger Outcomes, 69 J. Fin. Econ. 469, 470 (2003) (“The use of termination fees was a relatively uncommon practice in 1989, with approximately 2% of all deals including target fee provisions . . . . By 1998, however, termination provisions were significantly more prevalent with over 60% of all deals including target fee arrangements . . . .”); John C. Coates IV & Guhan Subramanian, A Buy-Side Model of M&A Lockups: Theory and Evidence, 53 Stan. L. Rev. 307, 315 (2000) (“Lockup incidence has generally increased over the period, growing from 40% of all deals in 1988 to 80% of all deals by 1998.”); Micah S. Officer, Termination Fees in Mergers and Acquisitions, 69 J. Fin. Econ. 431, 441 (2003) (“There is a marked increase over time in the number of deals in which the target agrees to pay a termination fee to the bidder.”).

[4]. Officer, for example, finds that the average value of termination fees as a percentage of total deal value stands at 3.80%. Officer, supra note 3, at 441. An oft-cited example that has diverted much attention to the use of lockups is Warner-Lambert’s 2000 decision to cancel its merger with American Home Products in favor of a merger with Pfizer, which resulted in payment of a $1.8 billion breakup fee to American Home Products. Robert Langreth, Behind Pfizer’s Takeover Battle: An Urgent Need, Wall St. J., Feb. 8, 2000, at B1.

[5]. See Coates & Subramanian, supra note 3, at 350 (“[T]he mere presence of a breakup fee (regardless of size) increases the recipient’s likelihood of closing . . . and larger fees have a larger impact . . . .”). Coates and Subramanian explain their findings through a myriad of buy-side distortions. They find similar results, though less pronounced, with regard to stock lockups. See id.; see also Bates & Lemmon, supra note 3, at 486 (“Overall, our results indicate that the presence of target termination fees is positively associated with deal completion . . . .”); Timothy R. Burch, Locking Out Rival Bidders: The Use of Lockup Options in Corporate Mergers, 60 J. Fin. Econ. 103, 114–15 (2001) (“[D]eals with lockup options are much more likely to be successfully completed . . . than are deals without lockup options . . . .”). Officer finds only weak evidence that termination fees discourage competition for the target. Officer, supra note 3, at 462.

[6]. See, e.g., Bates & Lemmon, supra note 3, at 471 (“Our results indicate that termination fee grants by merger targets have a substantial and positive effect on the probability of deal completion, suggesting that the use of termination fees may truncate an otherwise natural bidding process.”); Burch, supra note 5, at 109 (“The logical conclusion, then, is that lockup options are granted to deter third-party bidders, consistent with their observed effect and with the contentions of their critics.”); Coates & Subramanian, supra note 3, at 389 (“Lockups should be recognized for what they are—deal protection.”).

[7]. See Bates & Lemmon, supra note 3, at 494 (finding that “bid premiums are between 3.7% and 6.3% higher in deals that include target termination fees compared to deals that do not”); Burch, supra note 5, at 124 (finding that deals that include stock lockups result in a higher abnormal announcement return for target shareholders as compared to deals that do not include any type of lockup); Officer, supra note 3, at 462 (finding that “takeover premiums are not lower when a target termination fee is included in the merger terms and are potentially as much as 7% higher”). Coates and Subramanian, by contrast, find that “a higher premium is more likely with a stock lockup, or a larger stock lockup, but not with breakup fees . . . .” Coates & Subramanian, supra note 3, at 391. A recent empirical study found that third parties are not likely to make competing bids if termination fees are overly high, whereas moderate fees do not deter competition. Jin Q. Jeon & James A. Ligon,How Much is Reasonable? The Size of Termination Fees in Mergers and Acquisitions, 17 J. Corp. Fin. 959, 961 (2011).

[8]. A lockup is beneficial to a first bidder in that it reduces the reservation price of potential rivals and thereby allows the first bidder to win an auction for the target at a lower price. I regard this benefit as part of lockups’ compensatory role.

[9]. Note that the target’s loss from reduced competition is exactly offset by the acquirer’s profit.

[10]. See Ian Ayres, Analyzing Stock Lock-Ups: Do Target Treasury Sales Foreclose or Facilitate Takeover Auctions?, 90 Colum. L. Rev. 682, 715 (1990).

[11]. Reliance investment includes switching and coordination adaptations that will improve the target valuation for the specific acquirer. Accordingly, the greater the uncertainty of whether the deal will close, the lower the target valuation is for the acquirer.

[12]. First bidders’ valuation of the target is nonverifiable because bidders lack a direct means to convey their valuation of the target to potential rivals. Signaling serves as an indirect means of conveying such nonverifiable information. For a glossary of basic terms in game theory, see Douglas G. Baird, Robert H. Gertner & Randal C. Picker, Game Theory and the Law 301 (1994). Bidders differ in their valuations of the target because the synergy gains from acquiring the target depend on the specific characteristics of the acquiring firm and therefore vary among different companies. See, e.g., Lucian A. Bebchuk, The Case for Facilitating Competing Tender Offers, 95 Harv. L. Rev. 1028, 1034 (1982). Synergy gains include, inter alia, economies of scale in production and reduced costs of capital.

[13]. The technical argument I will make is that there exists a signaling equilibrium, under which lockups serve as signals differentiating high-valuing from low-valuing bidders. Signaling equilibrium is a specific case of a perfect Bayesian equilibrium, a solution concept wherein every player begins the game with beliefs that must be updated in light of new information and must be consistent with other players’ actions in equilibrium (that is, other players’ actions in equilibrium constitute an optimal response given that belief). See Baird, Gertner & Picker, supra note 12, at 312.

[14]. See Robert Charles Clark, Corporate Law 573 (1986) (“During a bidding war, of course, the shareholders would not approve any [lockup], but would prefer a free and unhampered auction for their shares.”); Lucian A. Bebchuk, The Case for Facilitating Competing Tender Offers: A Reply and Extension, 35 Stan. L. Rev. 23, 47 (1982) (“All the participants in this exchange agree that obstructive defense tactics [such as lockup arrangements with a white knight] should be prohibited.”).

[15]. Ayres, supra note 10, at 688.

[16]. Stephen Fraidin & Jon D. Hanson, Toward Unlocking Lockups, 103 Yale L.J. 1739, 1745 (1994) (footnote omitted). Fraidin and Hanson accordingly suggested enforcing all termination provisions, subject only to the business judgment rule. Id. at 1743.

[17]. Marcel Kahan & Michael Klausner, Lockups and the Market for Corporate Control, 48 Stan. L. Rev. 1539, 1565–66 (1996).

[18]. Id. at 1546.

[19]. Kermit Roosevelt III, Understanding Lockups: Effects in Bankruptcy and the Market For Corporate Control, 17 Yale J. on Reg. 93, 93 (2000); Peter Cramton & Alan Schwartz, Using Auction Theory to Inform Takeover Regulation, 7 J.L. Econ. & Org. 27, 29 (1991). Common value auctions involve an asset with the same underlying value for different bidders. Bidders differ only with regard to their estimations of that value. Independent private-value auctions, by contrast, involve an asset whose value varies among bidders. Each bidder’s valuation of the auctioned asset is independent of other bidders’ valuations.

[20]. See Roosevelt, supra note 19, at 111–12.

[21]. See generally Kahan & Klausner, supra note 17. A typical stock lockup gives the locked-in bidder a right to purchase a block of treasury shares (or authorized but not issued shares) at a predetermined price (a negotiated price or the merger price). The stock lockup recipient could then sell these shares to the second bidder at the latter’s offer price. Thus, the payoff under the stock lockup increases as the second bidder increases his bid for the target. Stock lockups that consist of only treasury shares are generally limited to 19.9% due to exchange rules that require shareholder approval of any action causing a higher percentage of additional shares to be listed. See, e.g., New York Stock Exchange Listed Company Manual § 312.03(c)(2). A less frequent form of a lockup is an asset lockup, which gives the acquirer a call option on a certain asset of the target at a predetermined price. See Fraidin & Hanson, supra note 16, at 1747. An asset lockup usually involves a particularly profitable or valuable unit of the target (a “crown jewel”) that might drive potential bidders’ interest in the target. Roosevelt, supra note 19, at 94.

[22]. See Burch, supra note 5, at 109.

[23]. See Officer, supra note 3, at 438–39.

[24]. The inception of the signaling literature is attributed to Michael Spence, Job Market Signaling, 87 Q.J. Econ. 355 (1973). Spence showed that workers could signal their competence to prospective employers by acquiring education that has no real value except for allowing employers to infer the worker’s quality. Id. at 356–58. For a comprehensive survey of the signaling literature, see generally John G. Riley, Silver Signals: Twenty-Five Years of Screening and Signaling, 39 J. Econ. Literature 432 (2001).

[25]. See, e.g., Sudipto Bhattacharya, Imperfect Information, Dividend Policy, and ‘The Bird in the Hand’ Fallacy, 10 Bell J. Econ. 259, 259 (1979).

[26]. Another example, pertinent to the analysis below, concerns the study of entry. Consider an incumbent monopoly that faces potential competition. If potential competitors have complete information about the incumbent’s unit cost (or any other relevant private information regarding the incumbent’s payoff), they will not be influenced by the incumbent pre-entry price. If, however, potential competitors face uncertainty with regard to the incumbent’s unit cost, the incumbent may profitably deter potential competitors by setting a “limit price” lower than the monopoly price it would have set in order to maximize short-run profit. Limit price strategy is a credible signal of an incumbent’s unit cost only if incumbents with high unit costs will not find it profitable to replicate the price policy of low-unit-cost incumbents. Also, limit price strategy will be employed only if low-unit-cost incumbents find that the profit resulting from reducing entry is greater than the short-run fall in profit due to charging lower prices. See generally Paul Milgrom & John Roberts, Limit Pricing and Entry Under Incomplete Information: An Equilibrium Analysis, 50 Econometrica 443, 444–45 (1982).

[27]. For a rigorous economic analysis of signaling motivation in English auctions, see generally Christopher Avery, Strategic Jump Bidding in English Auctions, 65 Rev. Econ. Stud. 185 (1998).

[28]. See Cramton & Schwartz, supra note 19, at 28 (pointing out the differences between an English auction and a takeover contest).

[29]. See Michael J. Fishman, A Theory of Preemptive Takeover Bidding, 19 RAND J. Econ. 88, 88–90 (1988) (outlining a model that assumes that there are no costs involved in revising bids as the bid price rises). See also Avery, supra note 27, at 187; Hirshleifer & Png, supra note 2, at 590 (outlining a model that assumes that bidders have to incur costs when revising their bids).

[30]. I assume throughout that takeover contests amount to independent private-value auctions, so that different bidders attach different values to the target depending on their expected synergy from acquiring the target.

[31]. I assume that the expected profit of second bidders from competing without ascertaining their valuation of the target is negative. Therefore, a second bidder considering whether to compete for the target will incur investigation costs aimed at learning its valuation of the target. A second bidder would incur these costs only if it believed that the first bidder’s valuation of the target is lower than some threshold value.

[32]. Bidders may resort to less credible strategies to convey their high valuation of the target to potential rivals. For example, in QVC Network, Inc. v. Paramount Communications, Inc., the merger was declared to offer the “greatest long-term benefits to stockholders and audiences around the world.” 635 A.2d 1245, 1252 (Del. Ch. 1993), aff’d, 637 A.2d 34 (Del. 1994). Sumner Redstone, Viacom Chairman and Chief Executive Officer, announced at a press conference that the deal was a “marriage made in heaven . . . [that would] never be torn asunder.” Id. He emphasized further that only a “nuclear attack” would break up the deal. Id.

[33]. I assume that the target would sell a lockup for an increase of 10 in the deal price, so that the decision to have a lockup is dependent solely upon the first bidder’s preference. See infra Part III.C.

[34]. For example, suppose that the emergence of a second bidder disrupts the first bidder’s strategic plans.

[35]. More specifically, with a probability of 0.8 the second bidder will find that its valuation of the target is below 700 and therefore will refrain from competing. In this case, it will lose 5—its investigation cost. With a probability of 0.2, the second bidder will find that it values the target at 760 and therefore will enter a competition. In this case, its profit depends on the first bidder’s type. The second bidder’s expected return is 40 ((0.5 × 60) + (0.5 × 20)), and because its bidding and investigation costs sum up to 15, its expected profit is 25.

[36]. If the second bidder believes that the probability that the first bidder is high-valuing is 5/8, its expected profit from investigating the target is 0 ((0.8 × -5) + (0.2 × (((3/8) × 45) + ((5/8) × 5)))).

[37]. A first bidder’s profit is equal to the difference between its valuation of the target and the deal price.

[38]. This assumption is made to simplify the example. Bidding up to its reservation price of the target is a best response for the first bidder (to the second bidder’s strategy), but not a unique best response (for example, not bidding at all is also a best response).

[39]. I assume that the first bidder is not allowed to drop from the auction once the second bidder has made a competitive bid. Bidding costs should therefore be interpreted broadly to include any costs resulting from the possibility of third-party competition. These costs need not be incurred when a third party actually enters a competition. For example, bidding costs might include loss of reputation or deal-specific investment.

40. Ayres, supra note 10, at 688.

[41]. Note that the first bidder’s type is not observable and not verifiable; that is, the second bidder cannot directly infer the first bidder’s type, and the high-valuing first bidder has no direct means to convey its type to the second bidder.

[42]. A perfect Bayesian equilibrium is a solution concept whereby each player begins the game with beliefs that must be updated according to Bayes’s rule. The action that each player takes in equilibrium must be sequentially rational; that is, it must be optimal given the beliefs of the player and the actions of all other players. See David M. Kreps & Robert Wilson, Sequential Equilibria, 50 Econometrica 863, 863 (1982).

[43]. The Intuitive Criterion is an equilibrium refinement in signaling games. An equilibrium refinement reduces the set of potential equilibria to the most plausible ones by restricting players’ beliefs off the equilibrium path. The Intuitive Criterion was introduced in In-Koo Cho and David M. Kreps, Signaling Games and Stable Equilibria. Quarterly Journal of Economics 102, (1987).

[44]. I assume that both parties are risk-neutral and that they share a common belief concerning the probability of third-party competition.

[45]. See Ajeyo Banerjee & James E. Owers, The Impact of the Nature and Sequence of Multiple Bids in Corporate Control Contests, 3 J. Corp. Fin. 23, 39–41 (1996) (showing that target returns to corporate control contests involving multiple bids and bidders are consistently higher than deals with noncompetitive bidding); Robert H. Jennings & Michael A. Mazzeo, Competing Bids, Target Management Resistance, and the Structure of Takeover Bids, 6 Rev. Fin. Stud. 883, 891–94 (1993).

[46]. See generally George A. Akerlof, The Market for “Lemons”: Quality Uncertainty and the Market Mechanism, 84 Q.J. Econ. 488 (1970).

[47]. Id. at 489.

[48]. Id.

[49]. With a probability of 0.8, the second bidder will not compete and the high-valuing first bidder’s profit will be 70. If a competition occurs, the low-valuing first bidder’s loss is -10, which constitutes its bidding costs. Therefore, the high-valuing first bidder’s expected profit, if it does not buy a lockup, is (0.8 × 70) – (0.2 × 10) = 54.

[50]. With a probability of 0.8 the second bidder will not compete and the low-valuing first bidder’s profit will be 30. If a competition occurs, the low-valuing first bidder’s loss is -10, its bidding costs. Therefore, the low-valuing first bidder’s expected profit if it does not buy a lockup is (0.8 × 30) – (0.2 × 10) = 22.

[51]. With a probability of 0.8 the second bidders will not compete and the target profit will be 670, the merger price. If a competition occurs, the high-valuing first bidder will bid up to 740, its reservation price of the target. Therefore, if a lockup is included in the agreement, the target’s expected profit, given that the first bidder is high type, is (0.8 × 670) + (0.2 × 740) = 684.

[52]. Analyses that focus on efficiency are often referred to as ex ante analyses. See Roosevelt, supra note 19, at 97–98.

[53]. See, e.g., Cramton & Schwartz, supra note 19, at 29.

[54]. This is especially important with respect to hostile takeovers. The seminal work on the disciplinary effects of the market for corporate control is Henry G. Manne, Mergers and the Market for Corporate Control, 73 J. Pol. Econ. 110, 113 (1965) (“Only the take-over scheme provides some assurance of competitive efficiency among corporate managers and thereby affords strong protection to the interests of vast numbers of small, non-controlling shareholders.”). Numerous articles have stressed the importance of the market for corporate control for controlling agency problems. See, e.g., Andrei Shleifer & Robert W. Vishny, A Survey of Corporate Governance, 52 J. Fin. 737, 756 (1997) (“Takeovers are widely interpreted as the critical corporate governance mechanism in the United States, without which managerial discretion cannot be effectively controlled.”); see also Lucian Arye Bebchuk, Toward Undistorted Choice and Equal Treatment in Corporate Takeovers, 98 Harv. L. Rev. 1693 (1985) (discussing the effect of current takeover rules); Frank H. Easterbrook & Daniel R. Fischel, The Proper Role of a Target’s Management in Responding to a Tender Offer, 94 Harv. L. Rev. 1161 (1981) (discussing the effect of a corporation’s managers’ resistance to premium tender offers); Ronald J. Gilson, A Structural Approach to Corporations: The Case Against Defensive Tactics in Tender Offers, 33 Stan. L. Rev. 819 (1981) (arguing for a different approach to tender offers).

[55]. See Bebchuk, supra note 12, at 1048 (“[A]cquirers may vary substantially in the amount of synergistic or managerial gains they can produce, and a rule of auctioneering increases the likelihood that the target will be acquired by the first to which its assets are most valuable.”).

[56]. See Easterbrook & Fischel, supra note 54, at 1175 (“Even resistance [by target managers] that ultimately elicits a higher bid is socially wasteful. Although the target’s shareholders may receive a higher price, these gains are exactly offset by the bidder’s payment and thus by a loss to the bidder’s shareholders. Shareholders as a group gain nothing; the increase in the price is simply a transfer payment from the bidder’s shareholders to the target’s shareholders.”).

[57]. See Cramton & Schwartz, supra note 19, at 29 (“The revenue maximization goal entered the law because of the way takeover litigations are conducted, but has no intellectual support. . . . The board is a fiduciary for target shareholders. Hence, the question for courts is whether the board fulfilled its fiduciary duty; in the takeover context, the duty is fulfilled by maximizing revenue to target shareholders.”); see also Coates & Subramanian, supra note 3, at 382–83 nn.213–14 and accompanying text.

[58]. See, e.g., Del. Code Ann. tit. 8, § 251 (2006) (explaining that mergers require board member action).

[59]. More generally, if the private gains are lower than the social return from search, parties will invest too little in searching for suitable contracting parties. Search costs will exceed the optimal social level, by contrast, if the social return is lower than the private gains from search. The social return for search in the context of corporate control transactions consists of two components: first, these transactions create value through synergies and management improvement; second, the prospect of corporate control transactions engenders a disciplinary effect for the management of public companies, thereby benefiting shareholders. See Cramton & Schwartz, supra note 19, at 30.

[60]. This is similar to the free rider problem in hostile takeovers. See Elazar Berkovitch et al., Tender Offer Auctions, Resistance Strategies, and Social Welfare, 5 J.L. Econ. & Org. 395, 396 (1989) (“By making an offer, the bidder signals the existence of synergy gains to other potential bidders and reduces their search costs. This reduction represents an externality, which is the public-good aspect of tender offers.”).

[61]. The argument that search is suboptimal is controversial among legal scholars. Some claim that a first bidder can insure its investment in identifying the target by making a toehold purchase of the target stock. See Lucian Arye Bebchuk, The Case for Facilitating Competing Tender Offers: A Last (?) Reply, 2 J.L. Econ. & Org. 253, 255–57 (1986). In the event that he loses a bidding contest, the first bidder can still make a profit by selling his shares in the target to a higher-valuing bidder. The possibility of a toehold purchase, in turn, provides sufficient incentive to search for acquisition candidates. See id. at 255 n.2; Ronald J. Gilson, Seeking Competitive Bids Versus Pure Passivity in Tender Offer Defense, 35 Stan. L. Rev. 51, 52 (1982). Others have argued that initial bidders nevertheless possess insufficient incentives to invest in search and therefore that encouraging search is efficient. See Berkovitch et al., supra note 60, at 399; Cramton & Schwartz, supranote 19, at 33 n.14; see also Roosevelt, supra note 19, at 108 n.62 (“But the excessive search thesis appears to be disfavored. In fact, it seems more plausible to suppose that efficiency is best served by allowing acquirers to capture all of the surplus from an acquisition.”).

[62]. An analogous case concerns the decision of a plaintiff to bring a suit against a defendant. The plaintiff’s decision involves a negative externality, as his decision forces the defendant to incur litigation costs. In the case of a plaintiff’s decision to initiate a suit, there is an additional negative externality concerning the administrative costs of the court system, as well as a positive externality concerning the social value of setting precedent.

[63]. Two comments are in order. First, even if lockups do not serve as signals, they can be used to preclude competition—although not from higher-valuing second bidders. This is because lockups deter competition from bidders who value the target higher than the merger price but lower than the sum of the merger price and the lockup amount. In this case, however, the preclusion of competition does not involve efficiency loss. The concern that target managements might usurp their authority thus exists even if lockups are not used as signals. Second, the efficiency effects associated with granting a lockup for no adequate consideration are indeterminate because the level of competition in a world without lockups may be higher than the first-best level.

[64]. See Coates & Subramanian, supra note 3, at 324–25.

[65]. See Cramton & Schwartz, supra note 19, at 33–36; Roosevelt, supra note 19, at 114–18.

[66]. Indeed, courts have employed a similar criterion in reviewing lockups. See Cottle v. Storer Commc’n, Inc., 849 F.2d 570, 576–77 (11th Cir. 1988) (“In exchange for the asset lock-up, Storer ultimately received a cash price of $91 per share, $16 more per share than KKR’s previous offer . . . . This improvement in the bid distinguishes Hanson, where the improvement was ‘at best one dollar and change’ above the previous $72 cash bid, and Revlon, where there was similarly ‘very little improvement’ in the subsequent bid.”) (citations omitted). In parentheses, the judge in Cottle describes the case as follows: “This is a shareholder derivative action involving white knights, poison pills, shark repellants, stalking horses, crown jewels, hello fees, goodbye fees and asset lock-up options.” Id. at 572. In other cases courts enjoined lockups because the resultant bid increases were insubstantial. See Mills Acquisition Co. v. Macmillan, Inc., 559 A.2d 1261, 1286 (Del. 1988) (“MacMillan cannot seriously contend that they received a final bid from KKR that materially enhanced general stockholder interests. . . . When one compares what KKR received for the lockup, in contrast to its inconsiderable offer, the invalidity of the agreement becomes patent.”); Revlon, Inc. v. MacAndrews & Forbes Holdings, Inc., 506 A.2d 173, 184 (Del. 1986) (“[T]he Revlon board ended the auction in return for very little actual improvement in the final bid.”); Hanson Trust PLC v. ML SCM Acquisition Inc., 781 F.2d 264, 281–82 (2d Cir. 1986) (invalidating lockup in part because bid increase was minimal).

[67]. For a similar view, see Brian C. Brantley, Note, Deal Protection or Deal Preclusion? A Business Judgment Rule Approach to M&A Lockups, 81 Tex. L. Rev. 345, 379–80 (2002) (“By focusing on the board’s process rather than whether a certain provision within the agreement is preclusive or not, courts will not replace provisions that are heavily negotiated between sophisticated parties with their own judgment.”).